In the last couple of months, momentum has been building in just about every precursor for stronger job growth. Real retail sales, real GDP, pesonal income and spending, and just this morning a dramatic drop in initial jobless claims to 406,000 - the lowest since July 2008 - all suggest that last month's gain of 169,000 jobs was just the foreshadowing of bigger and more sustained job growth next year.

If you can handle some actual data and not just selected secondhand punditry, I've got graphs and facts galore in support of a positive outlook for the economy generally, and job growth specifically, below.

I. Real retail sales

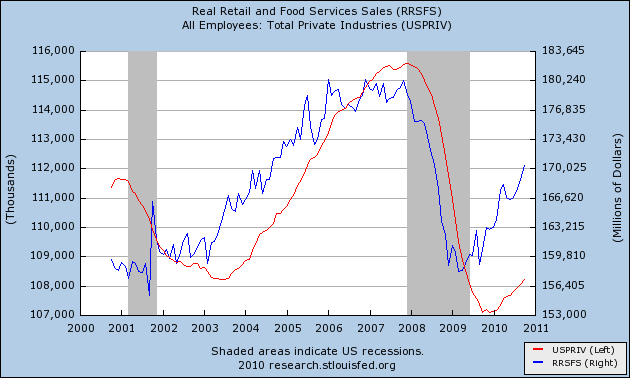

Over a year ago I identified real (inflation-adjusted) retail sales as the "Holy Grail," i.e., the best single leading indicator for job growth. With Monday's retail sales and yesterday's inflation reports, we can update the graph comparing real retail sales and jobs.

First, here are the absolute numbers (note in this first graph I am using private jobs rather than full payrolls to take out the census distortions):

Image may be NSFW.

Clik here to view.

As of October, real retail sales have made up more than half of their losses during the Great Recession.

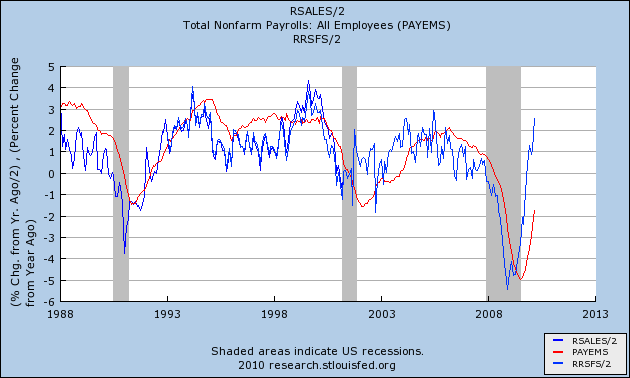

Here are the year over year percentage comparisons as they looked over half a year ago when I first posted them here:

Image may be NSFW.

Clik here to view.

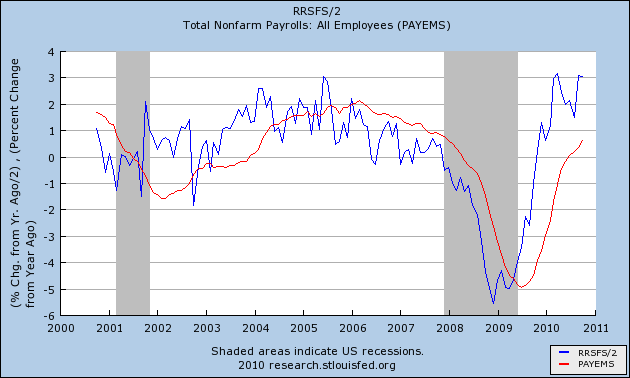

Here is what they look like now:

Image may be NSFW.

Clik here to view.

The relationship is holding up quite well.

In 4 of the last 7 months, real retail sales have been up over 6% on a year-over-year basis. Based on 65 years' worth of data, this translates into, <span style="font-style:italic;">at minimum,</span> 2% (or about 2.5 million jobs) year over year job growth, sometime soon. Whether "soon" is more like 6 months or 24 months is impossible to tell, but the trend is unequivocally positive.

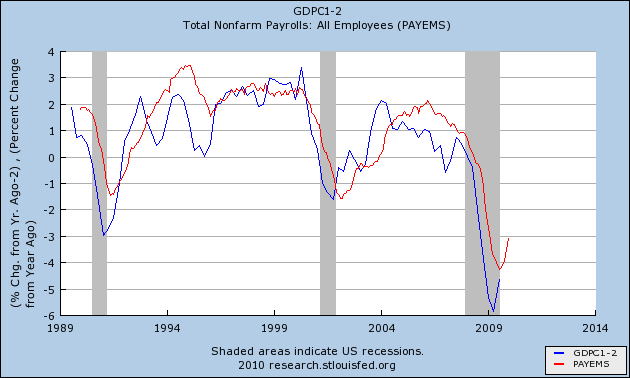

II. Real GDP

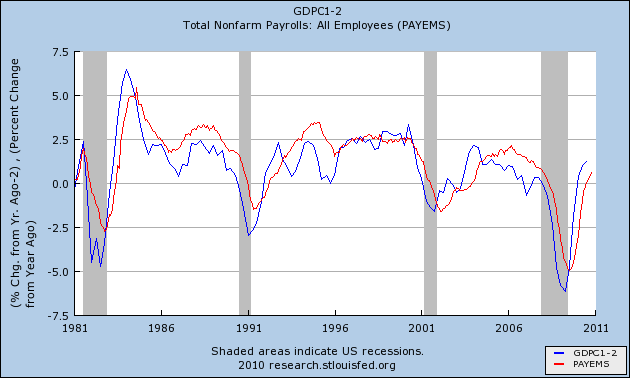

One of the best short-term precursors to job growth (besides real retail sales) is GDP growth. Generally it takes 2% YoY GDP growth to generate job growth, so normalizing for that, there is a very clear relationship.

Here is what it looked like nearly a year ago:

Image may be NSFW.

Clik here to view.

and here is what it looks like now:

Image may be NSFW.

Clik here to view.

Again, the relationship is holding up quite well, and suggests further job growth in the months ahead.

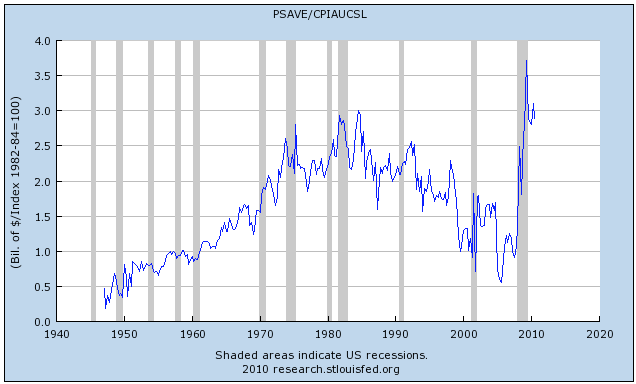

III. The Real Personal Savings Rate

Among the best longer-term precursors of job growth is the "real personal savings rate." To update this overview, first let's look at real, i.e., inflation-adjusted, saving. As you can see from this first graph, it is at the highest level in at least half a century:

Image may be NSFW.

Clik here to view.

Now let's take this same data and translate it into the real, inflation-adjusted, savings rate.Image may be NSFW.

Clik here to view.

This too briefly was at half-century highs at the very bottom of the recession. Since then the savings rate has declined, but is still in the higher range for the last several decades.

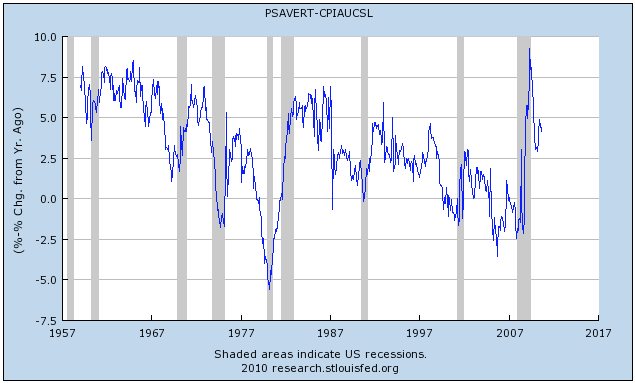

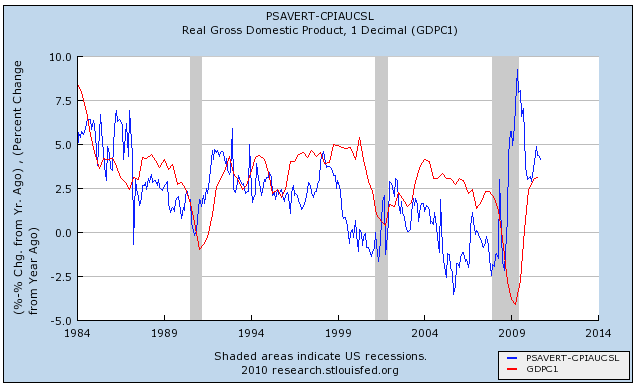

Now let's take the real personal savings rate (blue) and compare it with real GDP (red). Here is the relationship between 1959 and 1984:

Image may be NSFW.

Clik here to view.

and here is the same relationship from 1984 to the present (note: this is before this morning's data):

Image may be NSFW.

Clik here to view.

The relationship isn't perfect, but the lagged correlation is clear. A substantial change in the real personal savings rate is mirrored by a similar substantial change in real GDP about 6 to 18 months later. The logic of this isn't hard to follow: increased savings serve as the "tinder" that ignites subsequent spending. Once the spending starts, an economic boom begins. When the savings rate declines substantially, the fuel available for subsequent spending declines, and so does spending itself, with a lag.

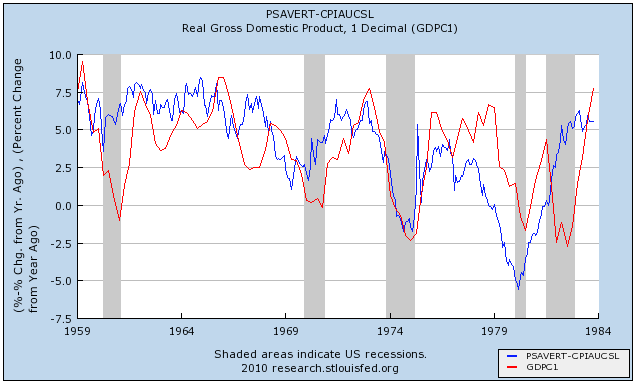

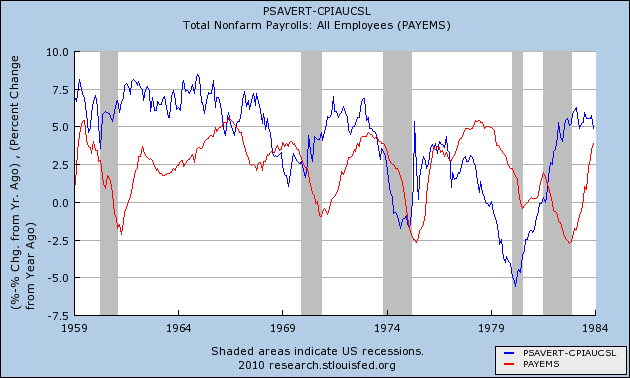

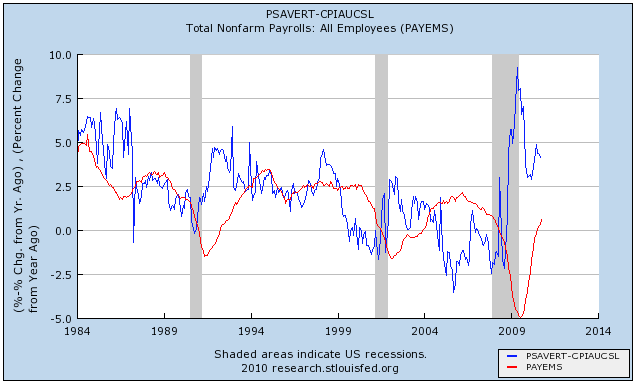

Since (1) the real personal savings rate leads real GDP; and (2) real GDP leads employment; let's put those two together and show the real personal savings rate (blue) and employment (red).

First, here is 1959 to 1984:

Image may be NSFW.

Clik here to view.

and here is 1984 to the present:

Image may be NSFW.

Clik here to view.

In summary, the real personal savings rate is a very good precursor for employment in a range of 18 to 30 months later. We are now 17 months past the June 2009 peak. This relationship predicts further increases in YoY job growth beginning about now and continuing in 2011.

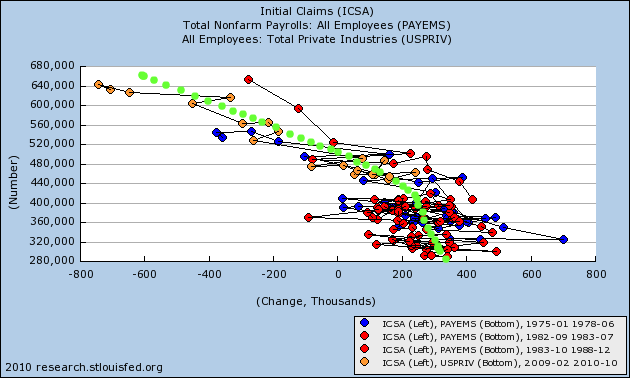

IV. Initial Jobless Claims Needless to say, I am very encouraged by this morning's drop in initial jobless claims to 407,000 (the best since July 2008), and the decline in the 4 week average to 436,000. Here is a trendline I drew on Monday comparing initial jobless claims with employment in the recoveries from the last two severe recessions:

Image may be NSFW.

Clik here to view.

This suggests that at a monthly average of 440,000 initial jobless claims a week, the average monthly payrolls gain is about 175,000 to 200,000, and gradually increases as initial jobless claims decrease. But there is an awful lot of variance, so that until such time as jobless claims drop below 360,000, even excepting a few outliers, any given month may give a number as low as ~75,000 or as high as ~350,000.

BTW, a similar point has been made by Ian Sheperdson of High Frequency Economics, who notes an intriguing rule of thumb: Each 10,000 drop in Weekly Jobless Claims sustained for a month is consistent with payroll growth rising by 25,000. (h/t Barry Ritholtz).

In conclusion, between real retail sales, declining jobless claims, a positive revision in GDP, and a wellspring of fuel in the real personal savings rate, almost all engines are "GO" for a takeoff in robust job growth into next year. Let's hope this morning's blowout upside surprise of initial jobless claims is only the beginning.

Happy Thanksgiving!